- Investor Accelerators

- Venture Capital Accelerator

- Real Estate Accelerator

- Professional Development

- Profit Sharing Agreement

- VC/PE Job Recruiting

- REVERSE DEMO DAY

- Education Programs

- Venture Capital

- Real Estate

- Team & Cohorts

- Venture Capital Team

- Private Equity Team

- Speakers, Instructors, Advisors

- VC Cohorts

- REPE Cohorts

- …

- Investor Accelerators

- Venture Capital Accelerator

- Real Estate Accelerator

- Professional Development

- Profit Sharing Agreement

- VC/PE Job Recruiting

- REVERSE DEMO DAY

- Education Programs

- Venture Capital

- Real Estate

- Team & Cohorts

- Venture Capital Team

- Private Equity Team

- Speakers, Instructors, Advisors

- VC Cohorts

- REPE Cohorts

- Investor Accelerators

- Venture Capital Accelerator

- Real Estate Accelerator

- Professional Development

- Profit Sharing Agreement

- VC/PE Job Recruiting

- REVERSE DEMO DAY

- Education Programs

- Venture Capital

- Real Estate

- Team & Cohorts

- Venture Capital Team

- Private Equity Team

- Speakers, Instructors, Advisors

- VC Cohorts

- REPE Cohorts

- …

- Investor Accelerators

- Venture Capital Accelerator

- Real Estate Accelerator

- Professional Development

- Profit Sharing Agreement

- VC/PE Job Recruiting

- REVERSE DEMO DAY

- Education Programs

- Venture Capital

- Real Estate

- Team & Cohorts

- Venture Capital Team

- Private Equity Team

- Speakers, Instructors, Advisors

- VC Cohorts

- REPE Cohorts

The Real Estate Private Equity & REIT Investment Apprenticeship

Program Overview

Develop The Skills, Experience, & Network For Breaking Into The Real Estate Private Equity & REIT Industry

• Join The Investment Team Of VU Capital Partners, A Global Private Equity Fund: Become an Analyst, Associate, Principal, or Partner-In-Residence (for Angels, Emerging Fund Managers, and individuals looking to join as a Partner at a Real Estate Private Equity Fund or REIT Fund)

• Learn & Work Alongside Top Performing Investors: 50+ years of Real Estate Private Equity & REIT investment experience, investing $7+ Billion as a Senior Partner at some of the world's largest real estate funds

• Develop Your Skills: Deal sourcing, doing due diligence, and investment evaluation

• Gain Broad Industry Experience: Choose a vertical investment team across Residential Real Estate, Commercial Real Estate, Industrial Real Estate, & REITS

• Weekly Partner Meetings: Present your top investment opportunities each week

• Investment Committees: Select investment opportunities to present to the Investment Committee and participate on the Investment Commiittee by reviewing and voting on investment recommendations

• Build A Portfolio & Establish A Track Record: Make ~1-2 real estate investments per quarter (up to ~8 investments over 12 months)

• Provide Portfolio Support: Help portfolio investments succeed

• Profit Sharing Agreement: Share in the financial upside on the investments made

• Earn A Certificate: Real Estate Private Equity & REIT Investment Experience

Schedule

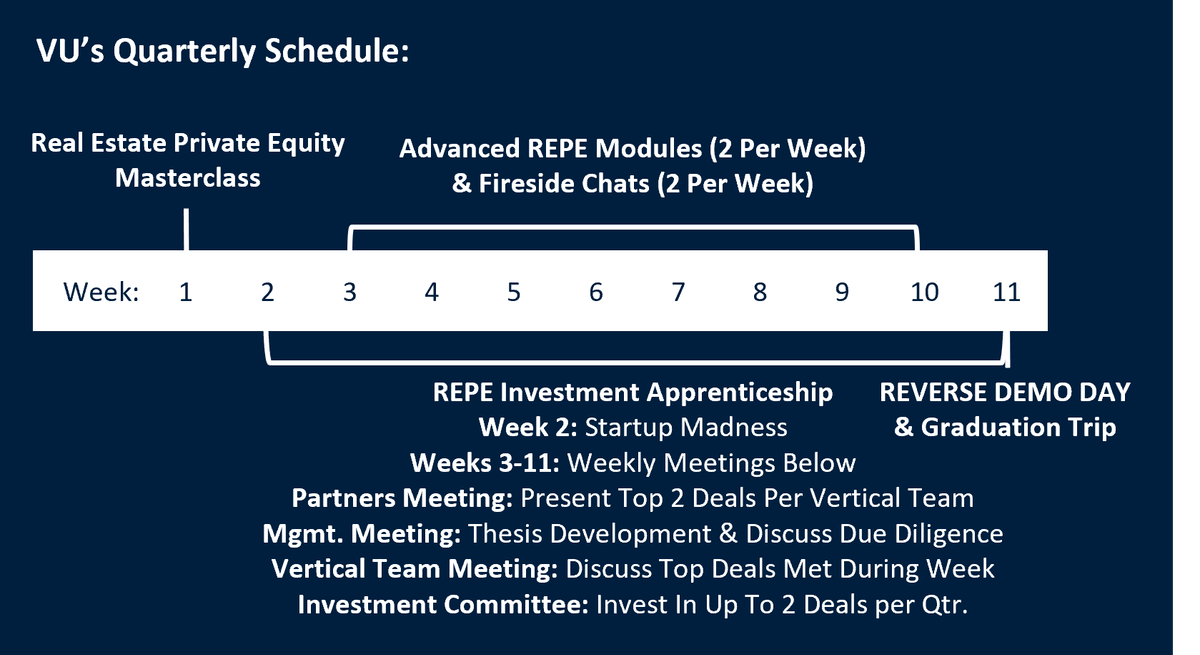

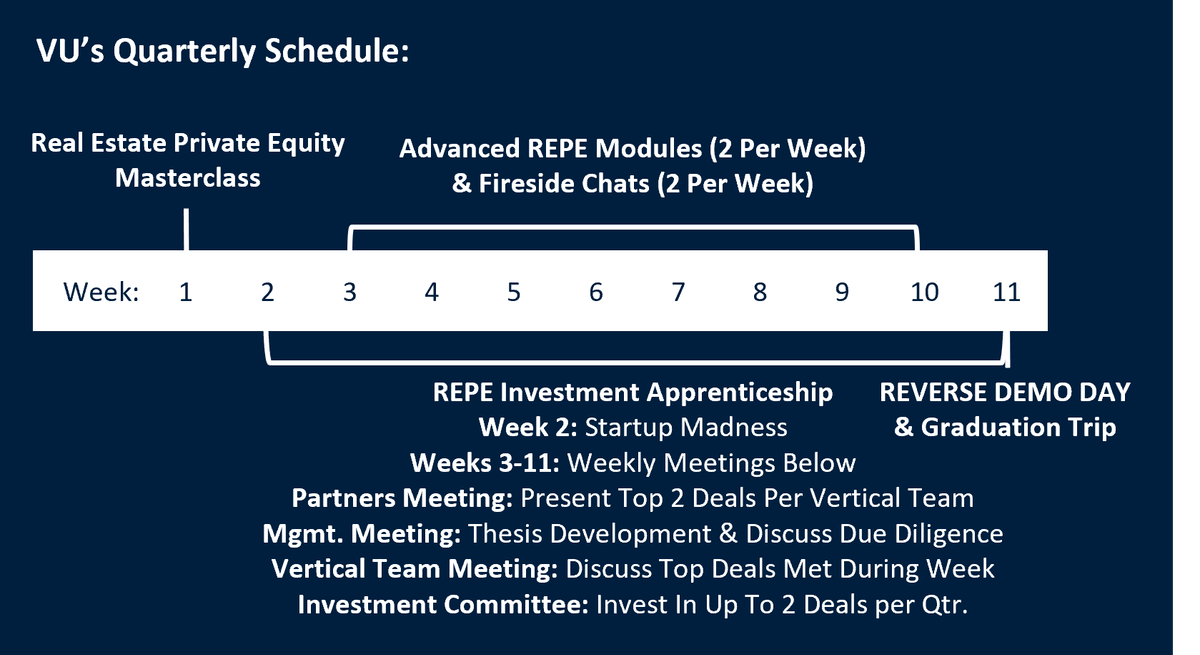

VU's Real Estate Private Equity & REIT Investment Apprenticeship is a 9 week program and starts week three of VU's 11 week Real Estate Private Equity & REIT Investor Accelerator program, after the two week Real Estate Private Equity & REIT Masterclass.

Individuals can do the Real Estate Private Equity & REIT Investment Apprenticeship for 1-4 quarters (~3-12 months) depending on the amount of investment experience the individual wants to gain and the size of the track record the individual wants to build by investing in up to ~8 real estate investments.

VU Has Quarterly Cohorts: Winter, Spring, Summer, & Fall.

Time Commitment:

• Full-Time: 10 Weeks, 5 Days per Week, Mon-Fri, ~9am-5pm

• Flexible: 10 Weeks, Minimum of ~20 Hours per Week

Locations

Attend VU's programs from our San Francisco office or virtually from anywhere!

San Francisco Office: 1700 Montgomery St, Suite 440, San Francisco, CA 94111, along the embarcadero overlooking the water and near Pier 39.

Cohort Members

• Individuals Looking To Join Real Estate Private Equity Funds and REIT Funds As A Analyst, Associate, Principals, Or Partner

• Individuals Looking To Join Or Launch Family Offices, Corporate Funds, & Institutional Funds

• Emerging Fund Managers

• Angel Investors & Family Offices

• Experienced Professionals & Industry Experts Looking To Transition Their Career Into The Real Estate Private Equity Industry

• Select Undergraduate & Graduate Students

Detailed Overview Of Investment Apprenticeship Program

Forming Vertical Teams:

At the end of Week 2, Cohort members form vertical deal sourcing teams focused on Residential Real Estate, Commercial Real Estate, Industrial Real Estate, REITs based on each cohort members interests, expertise, and background.

Case Studies & Start Reviewing New Opportunities:

Week 3 is where VU's investment leadership team reviews case studies and new opportunities.

Deal Flow Assignment:

Each cohort member is assigned opportunities to evaluate and channels to reach out to. These opportunties are sourced and identified by VU's internal deal flow tracking system of top opportunties.

Market Landscape Development:

Each cohort member identifies, builds, and evaluates their own market landscapes within the sub-verticals of their core vertical team's focus. Example: Residential Real Estate --> Ground Up Development vs. Value Add vs. Buy & Hold.

Sourcing Proprietary Deal Flow:

Each cohort member generates their own proprietary deal flow after being trained in core deal sourcing methodologies and adds to the overall total deals sourced per quarter.

Weekly Pipeline Meetings: Mondays

Each Monday, VU has a weekly Pipeline Meeting where each vertical team presents their top 1-2 opportunities to the General Partners. A decision is then made to pass or move forward into deeper due diligence on each opportunity. Each vertical team competes their prior weeks top deal flow with the current weeks top deal flow, narrowing down to their best investment opportunities over ~3 months.

Sponsor / Investor Meetings & Due Diligence Meetings: Mondays-Fridays

Each week the vertical teams meet with real estate sponsors / investors and discuss their due diligence with VU's senior investment team to ask questions, get feedback, and request introductions to help with deal sourcing and due diligence.

Weekly Vertical Team Meetings: Fridays

Each vertical team meets internally to select their top 1-2 opportunities to present at next week's Partner Meeting.

Investment Committees:

If there is an investment opportunity that has the conviction of one or more members of the cohort and investment team, the opportunity can be brought to the Investment Committee for review and approval. The Investment Committee includes VU's senior management team and the entire cohort. Each quarter there are usually 2-5 Investment Committee meetings, and each member of the cohort has the opportunity to pitch to as well as vote on the Investment Committees.

Green Lighting Investments:

Once an investment opportunity has received the "green light" at the Investment Committee, the investment opportunity is shared and presented to VU's Investor Syndicate, Bonded Capital VU's investors in the Investor Syndicate then select investments on a deal-by-deal basis. VU invests ~$100K-$1M+ per real estate opportunity and additional capital from committed funds.

If there is availability in the investment rounds, at VU's sole discretion, and with no obligation, current cohort members, VU alumni, and close relationships of cohort members and VU alumni may participate in the investment rounds if they are accredited investors. If a current cohort member participates in an investment round through VU's Investor Syndicate, there is no management fees or carried interest on their investment.

Investments:

Each cohort makes ~1-2 real estate investments per quarter.

There is no requirement for a vertical team to make a real estate investment during the quarter. Having the strength to pass on making an investment, and not feeling the need to make an investment, is an important lesson and skill to gain. Equally important is gaining the strength to pull the trigger when you've identified a truly extraordinary opportunity that has ability to yield a strong return and is worth the risk with real capital.

At the end of day, the goal is to make the best possible investments in any given quarter. It is important each cohort member acts as a team player, as all cohort members equally share in the upside across all investments made during the quarter.

"When I am sourcing for hiring analysts and associates for my fund, Venture University is at the top of my list" – Rusty Matveev, GP @ Global X Ventures

Disclaimer: *Foreign nationals participating in Venture University's program in the United States are not able to receive the profit sharing agreement as part of the Investor Accelerator unless they have a J1 Visa or other type of Visa allowing them to work in the United States. Individuals participating in Venture University's Investor Accelerator program outside of the United States are able to receive the profit sharing agreement. Individuals that participate in and complete the Investor Accelerator receive a profit sharing agreement that is tied to the future performance of the investments made during the program. Individuals that participate in Venture University's programs do not receive an equity stake in Venture University's investment funds or an equity stake in any of Venture University's portfolio companies. If an individual that participates in the Investor Accelerator is an accredited investor, then at Venture University's sole discretion, the individual may be allowed to, but is not required to, nor have any obligation to, invest in Venture University's investment fund or a portfolio company through Venture University's investment fund. There is no guarantee of any return of capital or profits from the investments made, as the risks of investing are high, the future outcomes from the investments are unknown, and could result in a 100% loss of invested capital in the portfolio companies, or result in a small or significant amount of profits for individuals in the Investor Accelerator which will be recognized as income and be taxable.

© 2018-2025