- Investor Accelerators

- Venture Capital Accelerator

- Real Estate Accelerator

- Professional Development

- Profit Sharing Agreement

- VC/PE Job Recruiting

- REVERSE DEMO DAY

- Education Programs

- Venture Capital

- Real Estate

- Team & Cohorts

- Venture Capital Team

- Private Equity Team

- Speakers, Instructors, Advisors

- VC Cohorts

- REPE Cohorts

- …

- Investor Accelerators

- Venture Capital Accelerator

- Real Estate Accelerator

- Professional Development

- Profit Sharing Agreement

- VC/PE Job Recruiting

- REVERSE DEMO DAY

- Education Programs

- Venture Capital

- Real Estate

- Team & Cohorts

- Venture Capital Team

- Private Equity Team

- Speakers, Instructors, Advisors

- VC Cohorts

- REPE Cohorts

- Investor Accelerators

- Venture Capital Accelerator

- Real Estate Accelerator

- Professional Development

- Profit Sharing Agreement

- VC/PE Job Recruiting

- REVERSE DEMO DAY

- Education Programs

- Venture Capital

- Real Estate

- Team & Cohorts

- Venture Capital Team

- Private Equity Team

- Speakers, Instructors, Advisors

- VC Cohorts

- REPE Cohorts

- …

- Investor Accelerators

- Venture Capital Accelerator

- Real Estate Accelerator

- Professional Development

- Profit Sharing Agreement

- VC/PE Job Recruiting

- REVERSE DEMO DAY

- Education Programs

- Venture Capital

- Real Estate

- Team & Cohorts

- Venture Capital Team

- Private Equity Team

- Speakers, Instructors, Advisors

- VC Cohorts

- REPE Cohorts

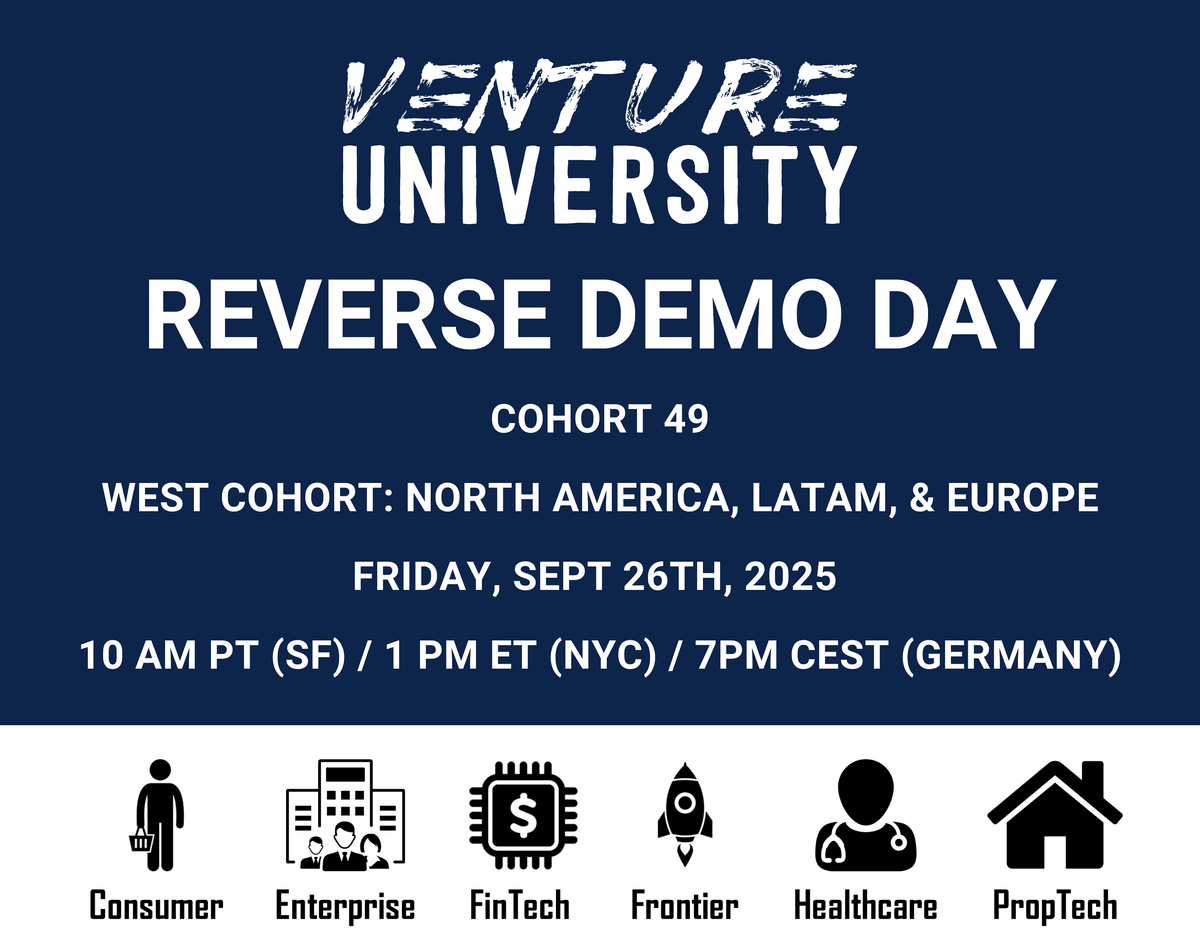

REVERSE DEMO DAY

VU Hosts REVERSE DEMO DAYS Each Quarter Where VU's Cohort Members Present The Investments They Have Selected

Date: FRI, SEPT 26, 2025

VC COHORTS 49

Or

Signup To Be Notified About The Next REVERSE DEMO DAY

What is REVERSE DEMO DAY?

Venture University is an "Investor Accelerator" vs. a "Startup Accelerator", so rather than having startups pitch at a DEMO DAY, VU's cohort of investors present the opportunities that they have selected to invest in at a REVERSE DEMO DAY where they share their investment thesis on each opportunity for why they said "yes" to invest.

The REVERSE DEMO DAY presentations are different from "startup pitches" as they from an investors perspective and include the insights from the due diligence completed, a more critical analysis of the problem/solution, discuss the significant magnitude of improvement over the "status quo", provide an honest market size (SAM) calculation, review key traction, metrics, risks, and share the return multiple potential.

During VU's 11 week Investor Accelerator program cohort members source ~5,000+ investment opportunities, conduct deep due diligence, and narrow down to making up to 7 venture capital invesments across new portfolio companies and follow-on invesrments, as well as ~1-2 real estate private equity investments. If you're an angel investor or family office and interested in co-investing in these opportunities each quarter, sign up to join VU's Investor Syndicate (Bonded): Sign Up Here.

Who are the cohort members in VU's Investor Accelerator?

VU's cohort members include three types of investors:

- Individuals looking to enter the VC/PE industry as Analysts, Associates, Principals, and Partners.

- Emerging fund managers, angel investors, and family offices.

- Entrepreneurs looking to think like an investor to identify their next opportunity or find a rocketship to join and scale.

Venture University has two investment funds:

1) VU Venture Partners, a global venture capital fund, which has six vertical investment teams: Consumer, Enterprise, Fintech, Frontier, Healthcare, & PropTech. VUVP invests in pre-seed to growth stage companies globally, investing $100K - $1M per investment.

2) VU Capital Partners, a real estate private equity fund, which has four vertical investment teams: Residential Real Estate, Commercial Real Estate, Industrial Real Estate, and REITs.

Why Attend REVERSE DEMO DAY?

Are you an investor?

Join Bonded - VU's Investor Syndicate and co-invest with over 7,500+ angel investors and family offices alongside VU's investment funds. Complete this form to select your investment preferences and start co-investing on a deal-by-deal basis across venture capital and real estate private equity, with as little as $5K per opportunity.

Are you looking to hire Analysts, Associates, Principals, or Partners to join your investment team?

If you're an investment group that is hiring submit the jobs you're hiring for and VU will curate 3-6 top candidates from our current cohort and VU alumni to interview for your job positions.

Are you an entrepreneur raising capital?

Are you looking for job opportunities?

View available jobs across VU's portfolio companies

Are you a corporation looking for innovation partnerships?

Come learn about VU's innovative portfolio companies that recently raised capital and see if there are any strategic partnership or investment opportunities with these companies.

Subscribe To Our Newsletter

© 2018-2025