- Investor Accelerators

- Venture Capital Accelerator

- Real Estate Accelerator

- Professional Development

- Profit Sharing Agreement

- VC/PE Job Recruiting

- REVERSE DEMO DAY

- Education Programs

- Venture Capital

- Real Estate

- Team & Cohorts

- Venture Capital Team

- Private Equity Team

- Speakers, Instructors, Advisors

- VC Cohorts

- REPE Cohorts

- …

- Investor Accelerators

- Venture Capital Accelerator

- Real Estate Accelerator

- Professional Development

- Profit Sharing Agreement

- VC/PE Job Recruiting

- REVERSE DEMO DAY

- Education Programs

- Venture Capital

- Real Estate

- Team & Cohorts

- Venture Capital Team

- Private Equity Team

- Speakers, Instructors, Advisors

- VC Cohorts

- REPE Cohorts

- Investor Accelerators

- Venture Capital Accelerator

- Real Estate Accelerator

- Professional Development

- Profit Sharing Agreement

- VC/PE Job Recruiting

- REVERSE DEMO DAY

- Education Programs

- Venture Capital

- Real Estate

- Team & Cohorts

- Venture Capital Team

- Private Equity Team

- Speakers, Instructors, Advisors

- VC Cohorts

- REPE Cohorts

- …

- Investor Accelerators

- Venture Capital Accelerator

- Real Estate Accelerator

- Professional Development

- Profit Sharing Agreement

- VC/PE Job Recruiting

- REVERSE DEMO DAY

- Education Programs

- Venture Capital

- Real Estate

- Team & Cohorts

- Venture Capital Team

- Private Equity Team

- Speakers, Instructors, Advisors

- VC Cohorts

- REPE Cohorts

The World's Leading Investor Accelerator For Venture Capital,

Private Equity, & Angel Investing

Join In-Person From VU's HQ Locations: North America (San Francisco), Asia-Pacific (Hong Kong), Europe (Munich), LatAm (São Paulo), Or Virtually From Anywhere

West Cohort: North America, Europe, LatAm, & Pan-Africa

Winter 2026: Jan 12 - Mar 27

Spring 2026: Mar 30 - Jun 12

Summer 2026: Jun 15 - Aug 28

Fall 2026: Sep 28 - Dec 11

East Cohort: Asia-Pacific, Middle East, & East Africa

Winter 2026: Jan 19 - Apr 3

Spring 2026: Apr 6 - Jun 19

Summer 2026: Jun 22 - Sep 4

Fall 2026: Oct 5 - Dec 18

View Venture University's Program Overview PDF

Mission: Venture University was created for individuals to gain high-quality investment experience in order to break into the VC/PE industry, launch their own funds, and advance their careers.

Learn By Doing: VU's Investor Accelerator includes both an Education Program (Masterclass, Advanced Modules, & Fireside Chats) and an Investment Apprenticeship Program where individuals join the investment team of a top-tier VC/PE fund, building skills in Deal Sourcing, Conducting Due Diligence, Investment Evaluation, and have the opportunity to present top deals at weekly Partner Meetings, make investment recommendations, and participate on the Investment Committee.

Build A Track Record: Join for 1 - 4 cohorts (3 - 12 months) to create an investment track record by making up to 7 investments per cohort (up to 28 investments over 12 months) and receive a Profit Sharing Agreement to share in the financial upside on your cohort's investments.

Certificates: Receive three program certificates (Masterclass, Advanced Modules, & Investment Experience) which can be added to your resume and shared on LinkedIn.

Access A Powerful Network: VU has graduated over 1,000+ alumni, across 50+ cohorts, who are working at and/or have launched their own VC/PE funds. VU also has a broader network across its investment team and alumni's personal network, as well as over 100+ portfolio companies, providing access to VC/PE funds, LPs, startups, large companies, and industry experts, which can lead to sought-after career and investment opportunities.

Venture University Stats

1,000+ VU Alumni, 50+ Cohorts

VU Is The Oldest, Largest, & Most Comprehensive Investor Accelerator In The World

~50% Get VC/PE Jobs

Within 12 Months Of Graduating

4 Cohorts per Year

per Investor Accelerator

Join For 3 - 12 Months.

Learn & Gain Investment Experience.

Make Up To 7 Venture Capital Investments per Quarter

Across New Portfolio Companies & Follow-On Investments, Each Targeting A ~10x+ Return

Build A Track Record: Make Up To 7 - 28 Investments Over 3 - 12 Months

Stage: Pre-Seed to Series B+

Structure: Direct Investments & Secondaries via VU's Committed Fund & Investor Syndicate

Make Up To 2 Real Estate PE Investments per Quarter

Across Real Estate Equity (1.5x - 2.5x) & Real Estate Debt (10% - 15% / year) Investments

Strategies: Ground Up Development, Value-Add, Fix & Flips, Buy & Hold, etc.

Asset Type: Residential, Industrial, & Commercial

Structures: LP or GP Funds

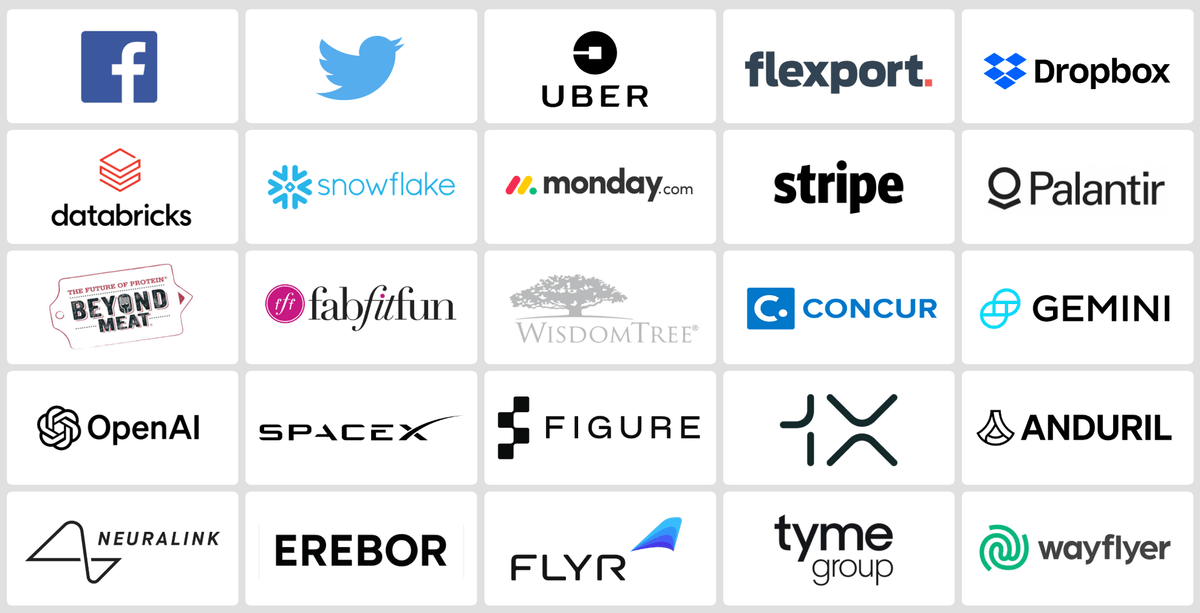

Portfolio Companies

VU is ranked as a top 2% performing venture capital fund, with including 10+ unicorns: SpaceX, OpenAI, FigureAI, 1X, Neuralink, Anduril, etc.

Check Out Our Portfolio:

100+ Venture Capital Portfolio Companies

10+ Real Estate Private Equity Portfolio Companies

2 Investor Accelerators

Each Investor Accelerator Includes:

• An Education Program (Masterclass, Advanced Modules, & Fireside Chats)

• An Investment Apprenticeship

• Three Certificates

6 Education Programs

2 Investment Apprenticeship Programs

Earn Up To 6 Certificates

Earn 3 Certificates (Masterclass, Advanced Modules, & Investment Experience) Per Investor Accelerator:

7 Vertical Venture Capital Investment Teams

- Consumer (B2C)

- Enterprise (B2B)

- Fintech (Financial Services, Blockchain, Crypto, Web3)

- Frontier (AI, Robotics, Materials, Space Tech)

- Healthcare (Digital Health, Med Devices, Biotech, Pharma)

- PropTech

- Climate Tech

4 Vertical Real Estate Investment Teams

- Residential Real Estate

- Commercial Real Estate

- Industrial Real Estate

- REITs

The Masterclass

100+ Topics, 25+ Hrs Of Content, 250+ Slides & Resources

Learn More:

The Advanced Modules

200+ Fireside Chats Across Venture & Private Equity Funds, Angels, Founders, & Strategics

75+ Years Of Top Performing VC Investment Experience

$2B+ Invested, 25+ Unicorns, 20+ Multi-Billion-Dollar Exits, 4x+ Net Realized Return, Top Decile Performing Fund

Investment Team's Track Record

50+ Years Of Top Performing Real Estate Private Equity Investment Experience

Senior Leadership Positions At The World's Largest Real Estate Investment Funds & Investing Over $7B

VU's Investor Syndicate:

VU Manages One Of The Largest Investor Syndicates With Over 7,500+ Angel Investors & Family Offices Investing On A Deal-By-Deal Basis

VU's 5 Campus Locations

Click To View VU's HQ Locations

San Francisco, CA (United States),

Hong Kong (China),

Munich (Germany),

Burgas (Bulgaria)

São Paulo (Brazil)

Investment Team & Cohort Members Are Located Across North America, LatAm, Europe, Asia-Pacific, Middle East, & Africa

Reviews & Testimonials

VU's Investment Managers Have Been Investors In 25+ Unicorns,

With 20+ Multi-Billion-Dollar Exits

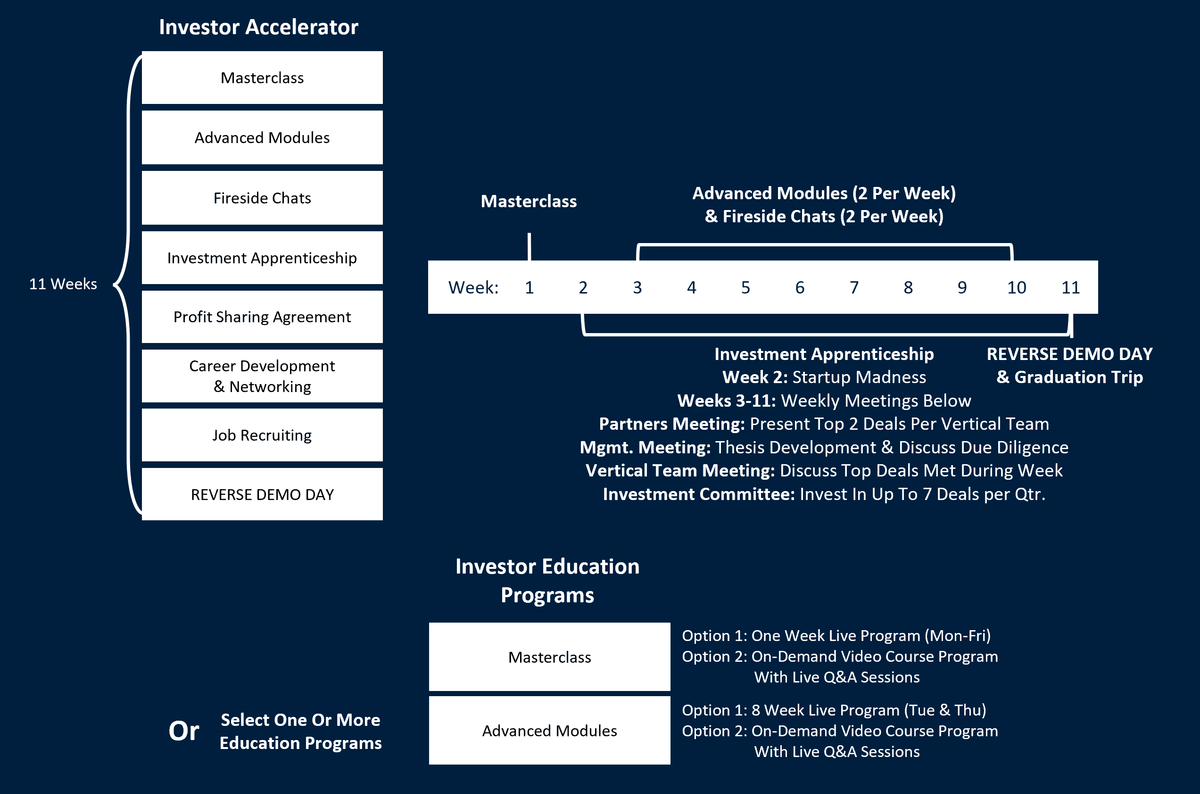

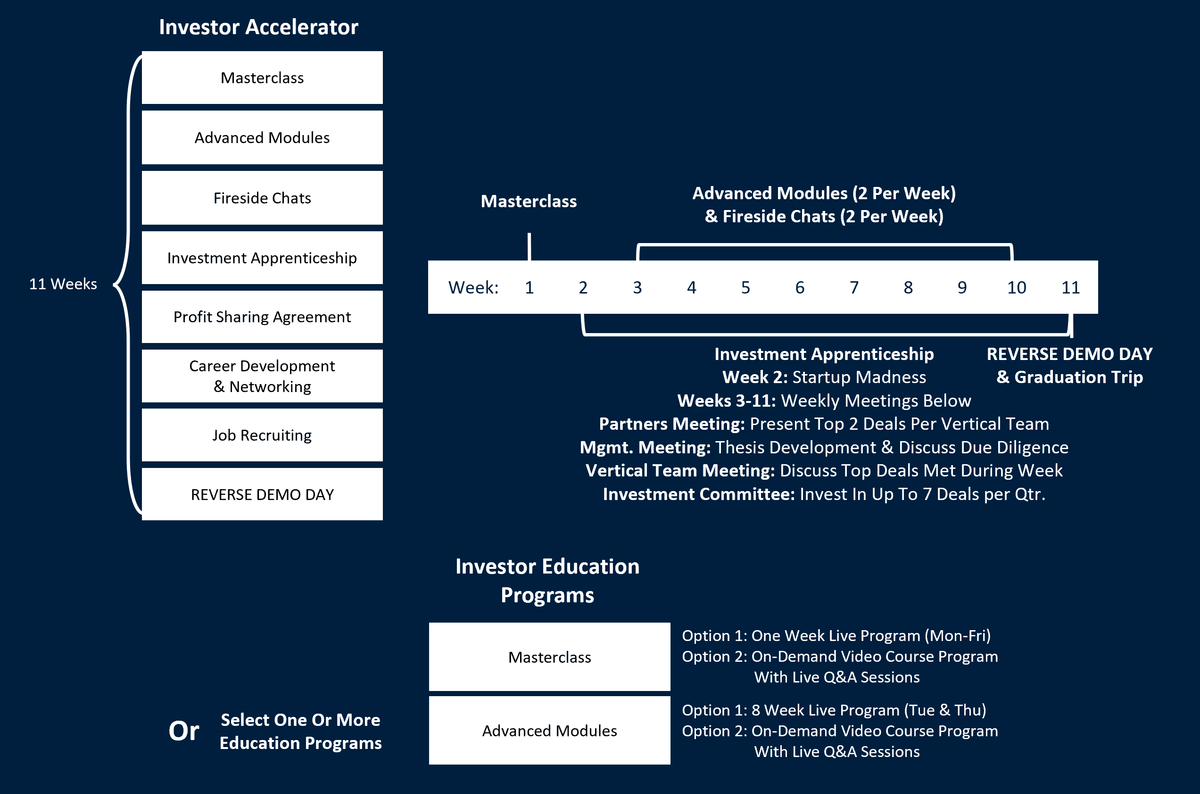

Venture University's Investor Accelerators Have The Below Program Structure & Schedule

Why Venture University Is The #1 Investor Accelerator In The World

42 Reasons & Growing!

Venture University Celebrates

7th Year Anniversary!

Announcing New Funds, New Platforms, & New Initiatives

Apply To One Of Venture University's Investor Accelerators Or Executive Education Programs

The Investor Accelerators

Learn, Gain High Quality VC/PE Investment Experience Over 3 - 12 Months, & Build A Track Record By Making Investments

VU Offers Two Investor Accelerators:

- Venture Capital Investor Accelerator: Learn More

- Real Estate Private Equity Investor Accelerator: Learn More

Each Investor Accelerator Is 11 Weeks & Includes:

Three Executive Education Programs:

- Masterclass

- Advanced Modules

- Fireside Chats

An Investment Apprenticeship Program:

- Build Skills: Deal Sourcing, Conducting Due Duligence, Investment Evaluation, Present Top Deals At Weekly Partner Meetings, Make Investment Recommendations, Participate On The Investment Committee

- Build A Track Record: Make Up To 7 Investments per Cohort (3 Months), Up To 14 - 28 Investments Over 2 - 4 Cohorts (6 - 12 Months)

- A Profit Sharing Agreement: Share Financial Upside On Your Cohort's Investments

- Career Development & Networking

- VC/PE Job Recruiting

- REVERSE DEMO DAY

- Alumni Events

- Graduation Trip

Triple Certificate Program:

- Certificate of Executive Education - Masterclass

- Certificate of Executive Education - Advanced Modules

- Certificate of Investment Experience - via VU's Investment Apprenticeship Program

Executive Education Programs

Enroll In One Or More Of The Executive Education Programs Below

Venture Capital: Learn More

- Venture Capital Masterclass: 1 Week Live or On-Demand Video Course

- Advanced VC Modules: 8 Weeks Live or On-Demand Video Course

- Fireside Chats: Live or On-Demand Video Library

- Dual VC Certificate Program

Real Estate: Learn More

- Real Estate Private Equity Masterclass: 2 Weeks Live or On-Demand Video Course

- Advanced Real Estate Modules: 8 Weeks Live or On-Demand Video Course

- Fireside Chats: Live or On-Demand Video Library

- Dual Real Estate Certificate Program

"Learn By Doing" At Venture University

"They've Read A Bunch of Words, I've Lived A Bunch Of Life," Jay-Z

"At Its Core, Venture Capital Is Truly An Apprenticeship Business"

Mahendra Ramsinghani, Author of The Business of Venture Capital

Meet VU's 2025 Cohorts

VU Has 1,000+ Global Alumni, Who Now Working At Other VC/PE Funds, Have Launched Their Own Funds, Angel Invest, & Have Become LPs In Funds

Bear Flag Robotics Acquired By John Deere For $250M

VU Cohort 8's portfolio company, Bear Flag Robotics, an autonomous driving farm tractor platform, returned ~10x in 14 months, yielding a ~700% IRR.

Venture University Launches VU Switzerland to Train the Next Generation of Swiss VC, PE & Angel Investors

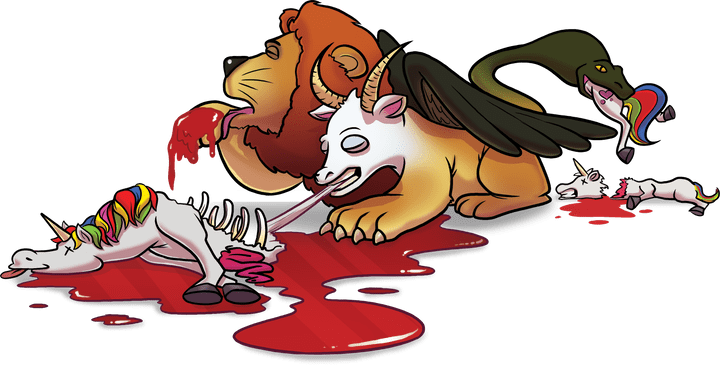

The Rise Of The Chimera: Eating Unicorns For Lunch

Understanding Market Size Dynamics For Company’s Worth $1+ Billion (Unicorns) to $1+ Trillion (Chimeras)

Spyce Acquired By sweetgreen

Robotic Restaurant Technology Brand Acquired By Rapidly Expanding Salad Restaurant Chain Prior To IPO

Infinite Reality Acquires Agentic AI Company Touchcast For $500M In A Deal That Values Infinite Reality At $15.5B

Made In Space Acquired by Redwire / AE Industrial Partners

VU's Portfolio Companies

100+ Venture Capital Portfolio Companies Aross Consumer, Enterprise, FinTech, Frontier, Healthcare, & PropTech

10+ Real Estate Private Equity Portfolio Companies Across Residential, Industrial, & Real Estate Debt

Venture University Receives

"Startup Of The Year" Award

Awarded For Disrupting The Venture Capital And Education Industry, & Increasing The Quantity & Quality Of Diversity Within The VC/PE Ecosystem

Hire VU's Cohort Members

& VU Alumni

Are you hiring Analysts, Associates, Principals, Partners to join your investment team?

Share the job opportunity with us and we'll curate the top 3-5 candidates for you to interview from VU's current cohort and VU alumni. Each quarter VU selects ~1% of the candidates that apply to be part of our Investor Accelerator.

Featured Articles

VU Launches VU Eurupe

Across Western Europe & Eastern Europe

VU Launches LatAm

Starting in Brazil, with plans to expand across LatAm!

The Benefits Of Joining Venture University

In-Depth & Hands-On Executive Education: Learn during an intensive Masterclass (1-2 Weels), with Advanced Modules over 8 weeks, and weekly Fireside Chats from top tier VC/PE investors, angels, founders, and strategics.

Gain High Quality Investment Experience For 3 - 12 Months Through An Investment Apprenticeship: Become an Analyst, Associate, Principal, Venture Partner / Partner-In-Residence, or Emerging Fund Manager at VU Venture Partners, a global venture capital fund and VU Capital Partners, a global private equity fund.

Earn Certificates: VU offers a Triple Certificate Program for Venture Capital and a Triple Certificate Program for Real Estate Private Equity & REITs, which can be authenticated by 3rd parties and easily shared.

Mentorship: Work alongside and learn from top performing investors with over 50+ years of venture capital experience and 50+ years of real estate investment experience. VU's senior investment partners have invested over $2+ Billion in venture capital, have been investors in 25+ unicorns (companies valued at over $1 Billion), including 20+ multi-billion-dollar exits. Additionally VU's senior real estate investment partners have invested over $7+ Billion in real estate and held senior leadehship positions within some of the largest real estate investment groups in the world.

Develop Critical Skills: Develop critical skills such as deal sourcing, conducting due diligence, investment evaluation, raising LP capital, and helping your portfolio succeed.

Develop Vertical Expertise Across Industries:

- Venture Capital Investor Accelerator: Join One Of 7 Vertical Investment Teams - Consumer, Enterprise, Fintech, Frontier, Healthcare, PropTech, & Climate Tech.

- Real Estate Private Equity Investor Accelerator: Join One Of 4 Vertical Investment Teams - Residential Real Estate, Commercial Real Estate, Industrial Real Estate, & REITs.

Build A Track Record:

- Venture Capital Investments: Make up to 7 venture capital investments per quarter, across new portfolio company investments and follow-on investments, each targeting a 10x+ return, and co-invest with other top tier investors. Over the course of 6 - 12 months you can build a track record of investing in up to 14 - 28 investments. View VU's venture capital portfolio companies. VU is benchmarked as a top decile performing venture capital fund.

- Real Estate Private Equity Investments: Make 1-2 real estate investments each quarter, 4-6 real estate investments over 12 months. View VU's real estate investments.

Receive A Profit Sharing Agreement: Cohort member share in the financial upside on the cohort's investments during the program via a Profit Sharing Agreement.

Advanced Career Experience: VU's Investment Apprenticeship program offers individuals a significantly more valuable opportunity for career development than an internship, a fellowship, or a scout program. Individuals within VU's Investment Apprenticeship program take on more senior roles within the investment team.

Cohort members are given the ability to:

- Select the top opportunities they want to present at the weekly Partner Meetings.

- Make investment recommendations, selecting opportunities to present to the Investment Committee.

- Participate on the Investment Committee and vote on the proposed investment recommendations.

Join For 1 - 4 Cohorts (~3 - 12 Months): VU's Investor Accelerators are 11 week programs and individuals can join for 1-4 cohorts (~3 - 12 months) depending on the amount of investment experience they want to get and the size of the track record they want to build.

Career Development: Update your resume with actual investment experience, work with VU to develop your career strategy, and receive career coaching and interview prep prior to conducing job interviews. Based on your experience and track record within the Investment Apprenticeship VU can provide job reference and recommendations for future employers.

Networking: Build a deep network within the VC/PE industry and join a powerful tight-knit family of 750+ VU alumni investors. VU hosts quarterly VU Alumni events to network with alumni and current cohort members.

VC/PE Job Recruiting: Gain access to proprietary VC/PE job opportunities and interview with VC/PE funds. Each quarter VC/PE funds recruit from VU and VU matches the jobs to current cohort member and VU alumni. Greater than 50% of VU alumni get VC/PE job offers within 12 months of graduating.

REVERSE DEMO DAY: Each quarter the cohort presents the investment thesis on the opportunties that they selected to invest in to an audience of investors and founders. Attend an upcoming REVERSE DEMO DAY.

Time Commitment: Individuals can join VU's Investor Accelerators on a full-time and part-time basis.

Locations: Attend VU's programs in-person or virtually from anywhere in the world. VU has offices in San Francisco, Hong Kong, Munich, and São Paulo.

"In financial terms, ROI on my MBA was nothing compared to VU. After 3 months, I made 5 investments that I have upside in, received 3 job offers, and now I'm an Associate Partner at a VC fund focusing on my passion of Internet of Things."

Ben Steven, Cohort 2 Member,

Associate Partner at Momenta Ventures

“Venture University gave me the opportunity, the skills, and the knowledge to get noticed by top-tier VC firms. The partners at VU have a sincere desire to help you achieve your career goals, and were incredibly supportive during my journey in landing two venture capital job offers, and one at a top accelerator.”

Alina Tioupikova, Cohort 2 Member,

Director at Techstars

VU Is Designed For Extraordinary & Exceptional Individuals Who Are:

• Looking to join or launch a VC/PE fund as an Analyst, Associate, Principal, or Partner

• Looking to join or launch a Startup Accelerator, Startup Studio, Family Office, Corporate Venture Fund, or Institutional Fund

• Emerging fund managers

• Angel investors and family offices looking to professionalize their direct investment strategies into startups and/or become LPs in funds

• Experienced professionals who are experts in their industry and are looking to make a career transition into venture capital or private equity

• Entrepreneurs who want to learn to think like investors prior to launching or joining a disruptive company

• Select undergraduate and graduate students

“I’ve gotten more hands on experience than I could ever have imagined. After 11 weeks, it felt like we’ve been here for 11 months! We were able to go through the entire investment process from deal sourcing, due diligence, to making investments, and we developed critical skills you can only get by doing the job of a VC.”

Yvonne Okafor, Cohort 2 Member,

Investment Analyst, Alitheia Capital

Build Equity In Your Education

Value Comparison: Undergrad vs. MBA vs. Venture University

“I had planned to spend the next 2-3 years slaving at an investment bank for a small shot at becoming a VC. Venture U provided me with an opportunity to leapfrog that pain and fast-track my career.”

Vitor Lima, Cohort 2 Member, Joined A Multi-Billion Dollar Family Office Doing Venture Capital

Join An Upcoming Cohort In San Francisco, Hong Kong, Munich, São Paulo,

Or Virtually From Anywhere

Disclaimer: *Foreign nationals participating in Venture University's program in the United States are not able to receive the profit sharing agreement as part of the Investor Accelerator unless they have a J1 Visa or other type of Visa allowing them to work in the United States. Individuals participating in Venture University's Investor Accelerator program outside of the United States are able to receive the profit sharing agreement. Individuals that participate in and complete the Investor Accelerator receive a profit sharing agreement that is tied to the future performance of the investments made during the program. Individuals that participate in Venture University's programs do not receive an equity stake in Venture University's investment funds or an equity stake in any of Venture University's portfolio companies. If an individual that participates in the Investor Accelerator is an accredited investor, then at Venture University's sole discretion, the individual may be allowed to, but is not required to, nor have any obligation to, invest in Venture University's investment fund or a portfolio company through Venture University's investment fund. There is no guarantee of any return of capital or profits from the investments made, as the risks of investing are high, the future outcomes from the investments are unknown, and could result in a 100% loss of invested capital in the portfolio companies, or result in a small or significant amount of profits for individuals in the Investor Accelerator which will be recognized as income and be taxable.

© 2018-2025