- Investor Accelerators

- Venture Capital Accelerator

- Real Estate Accelerator

- Professional Development

- Profit Sharing Agreement

- VC/PE Job Recruiting

- REVERSE DEMO DAY

- Education Programs

- Venture Capital

- Real Estate

- Team & Cohorts

- Venture Capital Team

- Private Equity Team

- Speakers, Instructors, Advisors

- VC Cohorts

- REPE Cohorts

- …

- Investor Accelerators

- Venture Capital Accelerator

- Real Estate Accelerator

- Professional Development

- Profit Sharing Agreement

- VC/PE Job Recruiting

- REVERSE DEMO DAY

- Education Programs

- Venture Capital

- Real Estate

- Team & Cohorts

- Venture Capital Team

- Private Equity Team

- Speakers, Instructors, Advisors

- VC Cohorts

- REPE Cohorts

- Investor Accelerators

- Venture Capital Accelerator

- Real Estate Accelerator

- Professional Development

- Profit Sharing Agreement

- VC/PE Job Recruiting

- REVERSE DEMO DAY

- Education Programs

- Venture Capital

- Real Estate

- Team & Cohorts

- Venture Capital Team

- Private Equity Team

- Speakers, Instructors, Advisors

- VC Cohorts

- REPE Cohorts

- …

- Investor Accelerators

- Venture Capital Accelerator

- Real Estate Accelerator

- Professional Development

- Profit Sharing Agreement

- VC/PE Job Recruiting

- REVERSE DEMO DAY

- Education Programs

- Venture Capital

- Real Estate

- Team & Cohorts

- Venture Capital Team

- Private Equity Team

- Speakers, Instructors, Advisors

- VC Cohorts

- REPE Cohorts

VU's Venture Capital Investor Accelerator

The Venture Capital Investor Accelerator

Program Schedule & Options

Program Overview

Venture Capital Investor Accelerator

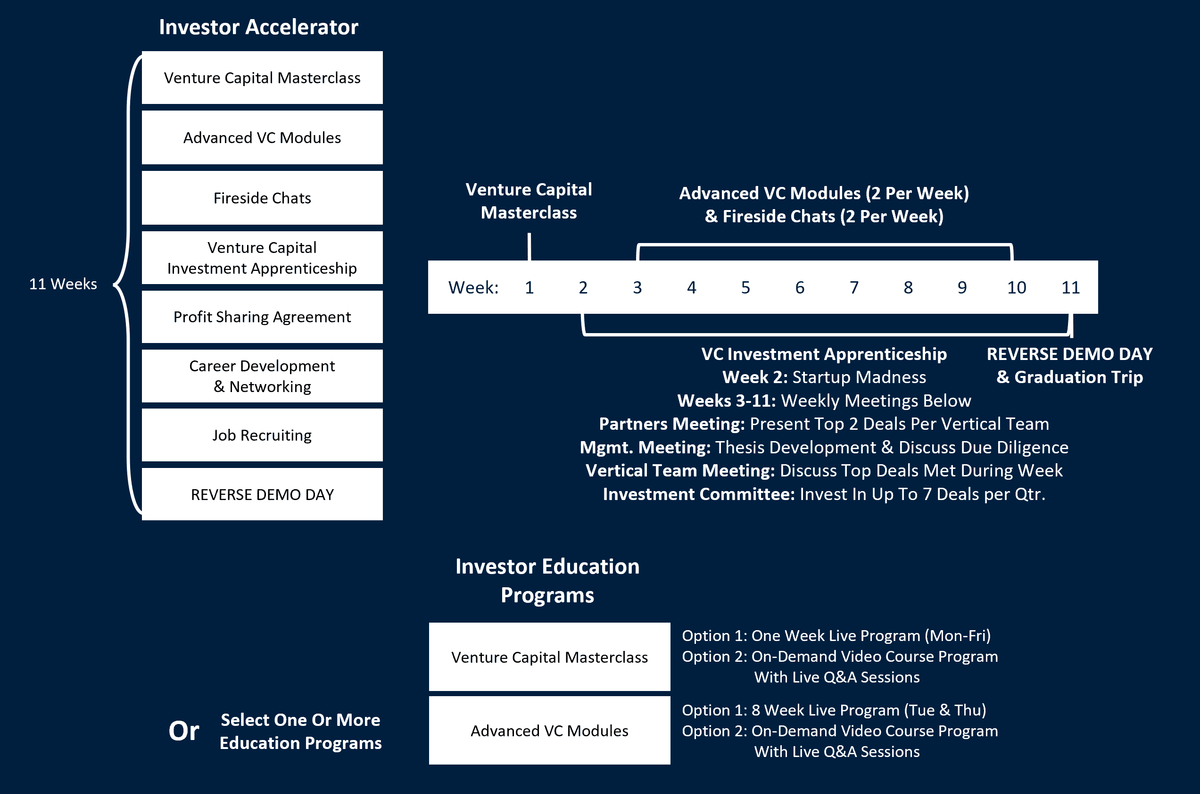

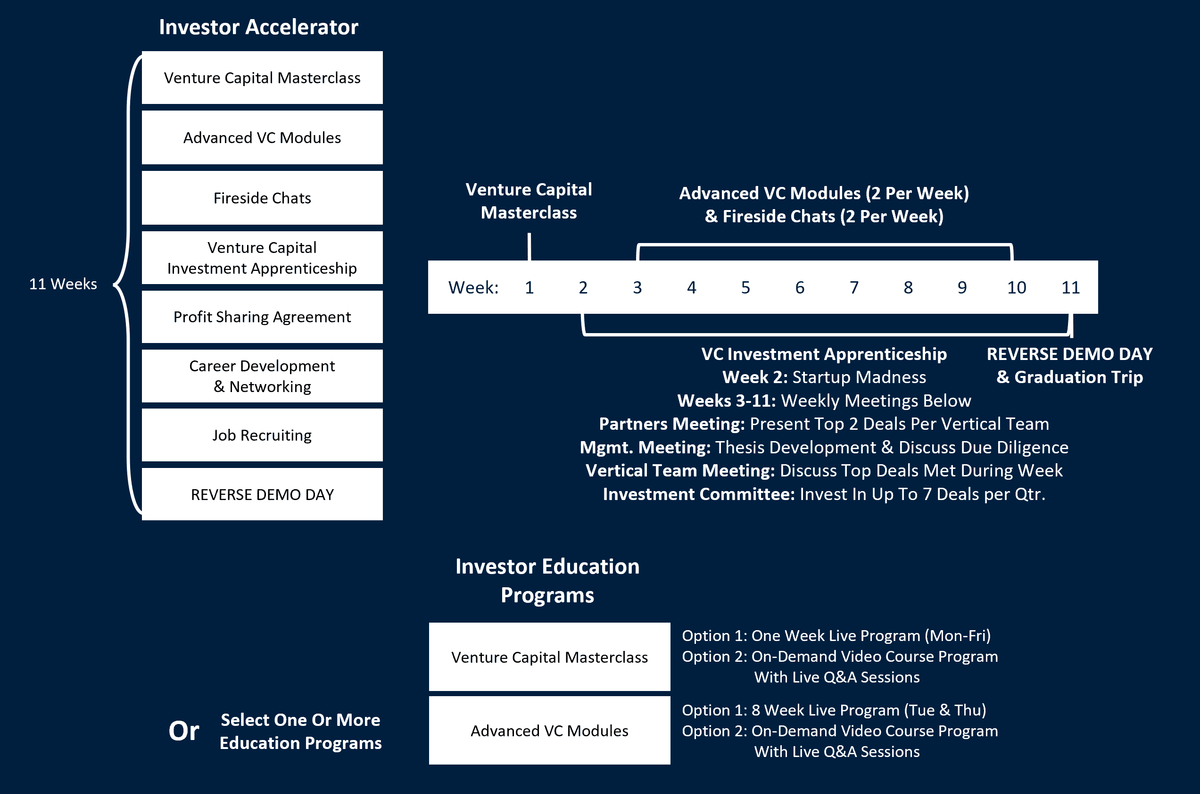

VU's Venture Capital Investor Accelerator is an 11 week live Triple Certificate Program which includes Three Executive Education Programs and a Venture Capital Investment Apprenticeship.

Executive Education Programs: 9 Weeks

• Venture Capital Masterclass: 1 Week / 250+ Slides.

• Advanced VC Modules: 8 Weeks / 16+ Modules.

• Fireside Chats: Weekly Fireside Chats.

• Content Library & Resources: Access to a library of video course material from the Venture Capital Masterclass, Advanced VC Modules, and over 200+ Fireside Chats, as well as access to multiple resources folders and documents.

Venture Capital Investment Apprenticeship: 3-12 Months

• Gain High Quality Venture Capital Investment Experience:

- Join A Venture Capital Investment Team: Become a Analyst, Associate, Principal, or Venture Partner at VU Venture Partners, a top performing global venture capital fund.

Develop Expertise: Choose a vertical team - Consumer, Enterprise, Fintech, Frontier, Healthcare, PropTech, & Web3. - Gain Skills: Deal sourcing, conducting due diligence, investment evaluation, presenting your top deals at weekly Partners Meetings, making investment recommendations, and participate on the Investment Committee.

- Build A Track Record: Make up to 7 investments per quarter, including new portfolio company investments and follow-on investments each quarter.

• Profit Sharing Agreement: Share in the financial upside on the investments made, each targeting a 10x+ return.

• Career Strategy & Development: Resume updating, career coaching, interview prep, job references, and recommendations.

• Networking: Join calls with venture capital funds and accelerators, attend startup / venture capital networking events, and attend VU alumni events.

• Venture Capital Job Recruiting: Each quarter VU receives exclusive job opportunities from Venture Capital funds hiring and matches them with VU cohort members and VU alumni.

• REVERSE DEMO DAY: The cohort presents the thesis for each portfolio company investment made during the quarter.

Schedule

Join VU's Venture Capital Investor Accelerator for 1-4 quarters (~3-12 months) depending on the amount of venture capital investment experience you are looking to gain and the size of track record you are looking to build.

At VU you can build a track record of investing in up to 7 companies per quarter, and up to 28 investments over 12 months.

VU Has Quarterly Cohorts: Winter, Spring, Summer, & Fall.

VU Has Two Geographic Cohorts Per Quarter:

• West Cohort: North America, Europe, LatAm, Pan-Africa

• East Cohort: Asia-Pacific, Middle East, & East Africa

Time Commitment:

• Full-Time: 11 Weeks, 5 Days per Week, Mon-Fri, ~9 am-5 pm

• Flexible: 11 Weeks, Minimum of ~20 Hours per WeekLocations

Join VU from HQ locations across North America (San Francisco), Asia (Hong Kong), Munich (Europe), or join virtually from anywhere.

San Francisco Office: 1700 Montgomery St, Suite 440, San Francisco, CA 94111, along the embarcadero overlooking the water and near Pier 39.

Hong Kong Office: Kinwick Centre, 32 Hollywood Road, Unit 801, Central, Hong Kong.

Cohort Members

• Individuals Looking To Join A Venture Capital Fund As A Analyst, Associate, Principal, Or Partner

• Individuals Looking To Join Or Launch Accelerators, Startup Studios, Family Offices, Corporate Venture Funds, & Institutional Funds

• Emerging Fund Managers

• Angel Investors & Family Offices

• Experienced Professionals & Industry Experts Looking To Transition Their Career Into The VC/PE Industry

• Entrepreneurs Who Want To Learn To Think Like Investors

• Select Undergraduate & Graduate Students

- Join A Venture Capital Investment Team: Become a Analyst, Associate, Principal, or Venture Partner at VU Venture Partners, a top performing global venture capital fund.

"Excellent program! You gain high quality VC/PE investment work experience, with a very hands-on "learn by doing" approach with the apprenticeship program, as well as benefit from an amazing in-depth academic component provided by a top-notch team with an incredible track record. I had a stellar experience! I'm joining for a second cohort along with a bunch of others from Cohort 7!"

Jeff Lazcano, Cohort 7 & 8

"Do it! You won't regret it. I was an Angel investor before VU, but I have an entirely new perspective for how I evaluate deals and feel I'm now performing at the top of my game. Venture Capital and Private Equity is an apprenticeship business and working alongside VU's team gives you a glimpse of what it's like to be working within a top venture capital and private equity fund,"

David de Jesus, Cohort 7 & 8

"Build Equity In Your Education"

With a traditional university, college, masters, or MBA program your tuition is a 100% sunk cost, is time consuming (1-4 years), and does not guarantee you will gain any relevant work experience for getting a career in the venture capital or private equity industry (only praying for internships of unknown quality).

At Venture University individuals in the Investor Accelerator gain high quality VC/PE investment work experience over ~3-12 months and "build equity in their education" by receiving a Profit Sharing Agreement which has the potential to be worth none, some, all, or more than the cost of the program.*

"Price Is What You Pay. Value Is What You Get."

Warren Buffett

Program Fee

• 1st Quarter: Gain VC/PE Investment Experience Over ~3 Months, Make Up to 5 Venture Capital Portfolio Company Investments Or Up To 2 Real Estate Private Equity Investments.

- Price: $20,000

• 2nd Quarter: Gain VC/PE Investment Experience Over ~6 Months, Make Up to 10 Venture Capital Portfolio Company Investments Or Up To 4 Real Estate Private Equity Investments.

- Price: $15,000

• 3rd Quarter: Gain VC/PE Investment Experience Over ~9 Months, Make Up to 15 Venture Capital Portfolio Company Investments Or Up To 6 Real Estate Private Equity Investments.

- Price: $10,000

• 4th Quarter: Gain VC/PE Investment Experience Over 12 Months, Make Up to 20 Venture Capital Portfolio Company Investments Or Up To 8 Real Estate Private Equity Investments.

- Price: $10,000

• Annual Discount (Paid Upfront) - Professional Gap Year Program: Gain VC/PE Investment Experience Over 12 Months, Make Up to 20 Venture Capital Portfolio Company Investments Or Up To 8 Real Estate Private Equity Investments. Ideal For Undergrads / MBA Students, Individuals Looking For Career Transitions, & Emerging Fund Managers

- Price: $45,000 (Save $10K)

Disclaimer: *Foreign nationals participating in Venture University's program in the United States are not able to receive the profit sharing agreement as part of the Investor Accelerator unless they have a J1 Visa or other type of Visa allowing them to work in the United States. Individuals participating in Venture University's Investor Accelerator program outside of the United States are able to receive the profit sharing agreement. Individuals that participate in and complete the Investor Accelerator receive a profit sharing agreement that is tied to the future performance of the investments made during the program. Individuals that participate in Venture University's programs do not receive an equity stake in Venture University's investment funds or an equity stake in any of Venture University's portfolio companies. If an individual that participates in the Investor Accelerator is an accredited investor, then at Venture University's sole discretion, the individual may be allowed to, but is not required to, nor have any obligation to, invest in Venture University's investment fund or a portfolio company through Venture University's investment fund. There is no guarantee of any return of capital or profits from the investments made, as the risks of investing are high, the future outcomes from the investments are unknown, and could result in a 100% loss of invested capital in the portfolio companies, or result in a small or significant amount of profits for individuals in the Investor Accelerator which will be recognized as income and be taxable.

© 2018-2025